They’re available anywhere via cloud software and you can upload pictures and receipt copies to a single location. SmartFinancial prefers digital over physical home inventory lists. You can create a home inventory list using an online spreadsheet, a physical notebook or a home inventory app. Homeowners usually inventory just their high-value possessions but you can choose how comprehensive you want it to be. Do you have a collection of vintage bobbleheads that you love? Go ahead and include those. Make a list of all items in your home that you would like to include in your inventory.

HOME INVENTORY FOR INSURANCE UPDATE

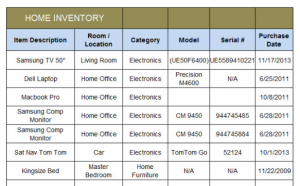

Update your inventory regularly so the belongings that matter most are accounted for and protected.Ī fairly straightforward process, here’s a simple five-step for creating a home inventory list: 1.You should complete a home inventory because it helps your insurance company calculate your reimbursement payout after a covered accident.Your home inventory should include photos and receipts.We recommend digital over physical home inventories because you can have all your information in one easily accessible location without worrying about a hardcopy getting lost in an accident.A home inventory list is an itemized document that contains images of your personal belongings, their value and the date of purchase.Review our guide to see how you can create an inventory list along with examples of what to include. During the claims process, a home inventory list makes it easy to provide your insurer information about what property was lost, how much each item costs and proof of purchase via receipts and pictures. Creating a home inventory can help ensure you get compensated for your valuable possessions in the event of a covered loss.

0 kommentar(er)

0 kommentar(er)